The Glazer family have been offered the financial backing to remain as owners of Manchester United by American hedge fund Elliott Management, sources have told ESPN, after the New York-based group registered an interest in investing in the Premier League club.

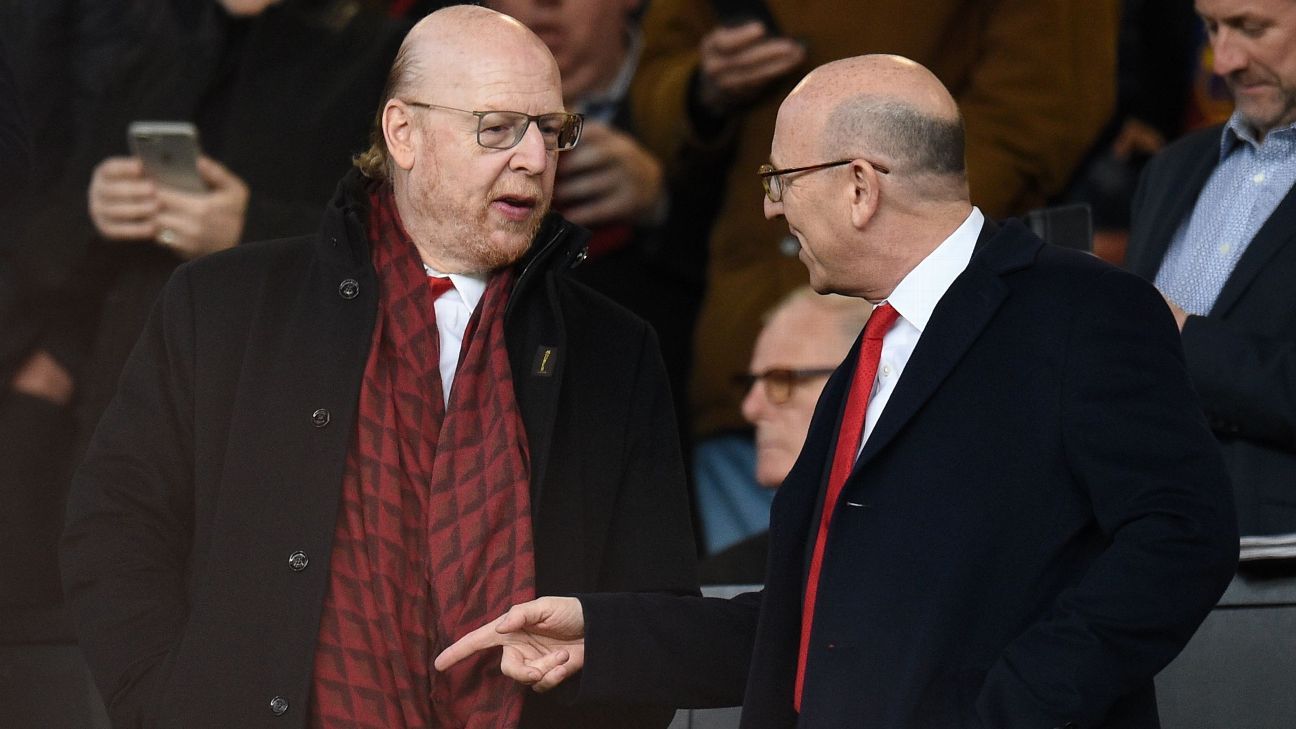

Elliott’s emergence in the sale process of United opens up the prospect of Joel and Avram Glazer, the club’s co-chairpeople, retaining an interest in the club, despite deep-rooted opposition from the United fan base to the American family that also owns the Tampa Bay Buccaneers.

– Qatari sheikh launches bid to buy Man United

– Stream on ESPN+: LaLiga, Bundesliga, more (U.S.)

Following their announcement last November that they had enlisted Raine Group, the U.S. bank that oversaw the £2.5 billion sale of Chelsea last May, to seek “strategic alternatives” for the running of United, the Glazers have received at least two offers from rival bidders to buy the 20-time English champions.

British businessperson Jim Ratcliffe, the founder of chemicals company INEOS, and Sheikh Jassim Bin Hamad Al Thani, the chairman of the Qatar Islamic Bank, both submitted sealed bids to buy United ahead of last Friday’s 5 p.m. ET deadline for offers to be registered with Raine.

But while both Ratcliffe and Sheikh Jassim have stated their determination to become majority or sole owners of United, ESPN reported earlier this month that Joel and Avram Glazer were also keen to attract outside investment to help fund the modernisation of Old Trafford and the construction of a new training ground.

Sources involved with the bidding process have told ESPN that Elliott Management’s proposal is for “possible financing, not a bid for the club.”

– Dawson: Rashford has Man United riding wave of optimism

Elliott, who have assets of $55 billion, made their proposal to Raine last week and are prepared to help finance a bid for United.

But with both Ratcliffe and Sheikh Jassim preparing to fund their own bids, sources have said that Elliott’s entry into the process offers the Glazers and Raine the opportunity to negotiate investment for the existing owners if a full sale cannot be achieved.

Elliott, who previously financed former AC Milan owner Li Yonghong before the Italian club were sold to Redbird in 2022, are regarded as one of the largest activist investor funds in the world with a reputation for aggressive tactics in asset management.

In 2012, the Argentine naval ship, ARA Libertad, was seized by Elliott in an attempt to collect bonds on which the Argentine government had defaulted in 2001.